Despite the global pandemic having passed the one-year mark, venture capital (VC) funding remains at an all-time high. This speaks volumes about the optimistic view that VCs – as well as private equity (PE) firms and their limited partners – continue to take on the global economy’s health. There’s lots of money out there and they are aggressively putting it to work. The Q4 PwC MoneyTreeTM survey results bear this out: last year, VC-backed companies raised nearly $130 billion, a 14% year-over-year increase from 2019.

Given this frothy environment, our clients and emerging companies often ask, “how do we stand out to get broad exposure with media and important stakeholders for our investment news?”

The honest answer: it is getting increasingly difficult. However, with proper planning, a smart strategy and flawless execution, startups – even those in the earlier stages – can generate widespread media coverage and industry awareness.

Our funding experts combined their extensive experiences with a final takeaway from Carol Wentworth, Marketing Partner, Threshold Ventures and DFJ Growth, to create ten winning tips to maximize your funding announcement.

1. Plan Ahead

However basic, it’s surprising how few companies give themselves enough runway for this type of landmark announcement. Perhaps it’s due to the confidential nature of the news, the communications team is brought in at the last minute or the number of stakeholders involved creates fear of a leak. Internal and agency comms teams should be involved at least three weeks prior to the scheduled announcement date to begin executing on the next 9 tips as well as develop an iron-clad FAQ document for all parties involved.

2. Set Your Media Strategy

What are your goals? The often elusive TechCrunch story? A broadcast segment? Cracking Fortune, The Wall Street Journal or another business/financial outlet? Depending on the size of the funding round – whether a Series A round or huge PE investment – or if it involves a new investor, these factors dictate whether the path forward might involve an exclusive or embargoed news approach. Keep in mind that many of the top tier publications – Fortune, Bloomberg, Reuters, etc. – are drawing a hard line on funding news now and will only cover announcements as an exclusive, no matter how many zeroes the round contains.

3. Give Media a Reasonable Runway

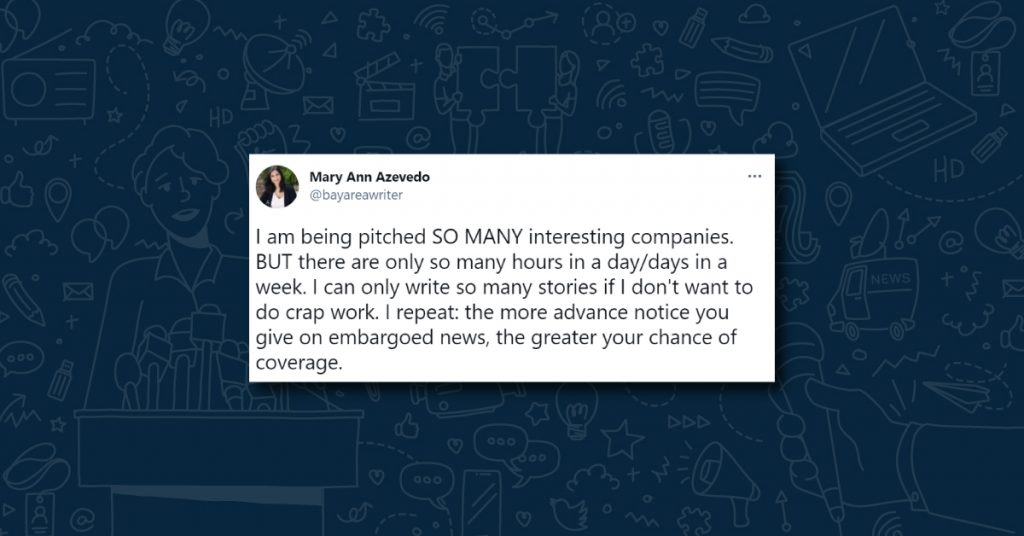

Reporters are busy and need time when approached with embargoed news. The sheer number of financial related news – VC and PE rounds, M&As, IPOs, SPACs (Special Purpose Acquisition Company) deals – has intensified in recent months, creating additional challenges for media to absorb and analyze news beforethey determine what they can cover effectively. Every media outlet is different and even different reporters at the same outlet have their respective preferences. TechCrunch for one, typically prefers anywhere from two to five business days’ advanced notice.

4. Involve the Investment Partners

This is often a critically overlooked step. After all, these are the folks who have just cut a substantial check AND their input can be hugely valuable. The VC or PE firm can likely provide the “story behind the story” or “go beyond the numbers.” This can be critical to the storytelling aspect. Furthermore, they or their PR team might be willing to share key media relationships as they often deal with this subset of media on a weekly basis. Investment partners must be in synch with the overall media strategy, timeline and desired outcome.

5. Temper Expectations

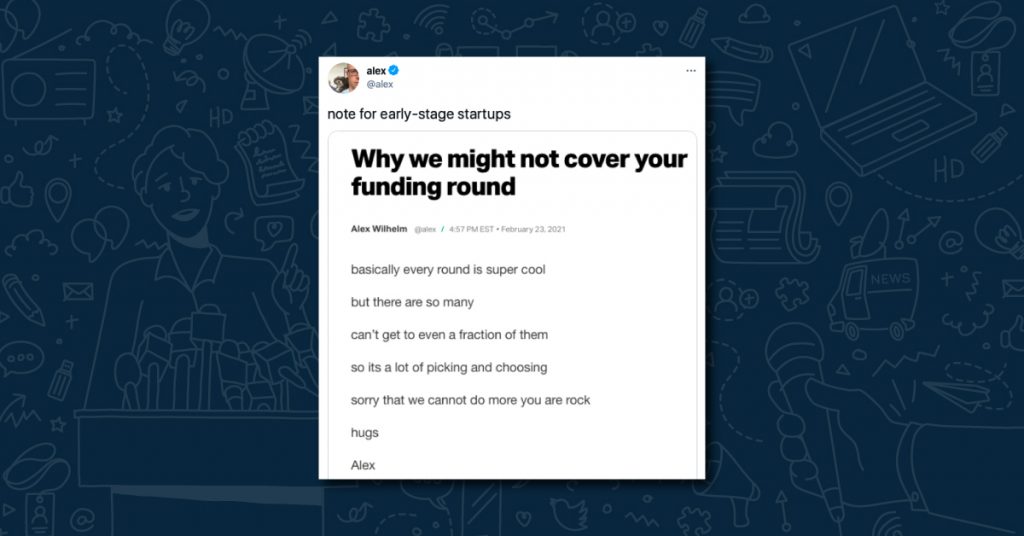

This is a tough topic. Clients and company executives often have high expectations given how hard they have worked to secure funding. But the VC press cannot cover every deal announced – it’s like a page of out Economics 101: supply and demand. And the steadily increasing number of big deals adds to the challenge of capturing busy reporters’ and editors’ attention. The PwC report reveals that “mega rounds” are becoming the norm, not the exception. 2020 saw a record 318 rounds worth $100M or more. More often than not, a quality over quantity approach is the way to go when determining where to focus on securing ink.

6. Have a Plan B

Think beyond the dollar signs. Take the time to establish what is truly differentiated about this announcement from either the investors or portfolio company’s standpoint. It’s no longer enough to say that this is significant because of the market potential or because a company raised money during a pandemic. And if your exclusive or embargoed pitching needs to be adjusted based on media interest, be ready to pivot quickly and decisively.

7. Know Your Audience

The Wall Street Journal, The New York Times, Forbes, Fortune, TechCrunch, Crunchbase News, VentureBeat, Business Insider, Buzzfeed, and CNBC represent the top tier. Additionally, newsletters like StrictlyVC, Fortune’s TermSheet, Mattermark and Pitchbook include roundup coverage of new financings. The industry press, however, rarely cover funding news and broadcast outlets are also selective, but don’t ignore them.

8. Beware of Leaks

Funding announcements attract leaks like elections foster controversies. Do whatever you can to prevent them by limiting the circle of insiders and commit them to a non-disclosure agreement (NDA). And remember, social media mentions can absolutely kill your news’ value and put the most carefully orchestrated embargo into a tailspin from which it might not recover.

9. Amplify the News

Despite the previous tip’s caution, social media channels and other “owned” platforms are your friends. Sharing links via Twitter, Facebook and LinkedIn drive awareness of the news. For truly special instances, consider a video message from your CEO for distribution on YouTube or Vimeo. It’s also critical to provide the information directly to employees, partners and customers in a way that underscores your company’s key messages and makes it easy for them to spread the word. Finally, writing your own blog post to be posted on your company site, LinkedIn and Medium provides more opportunity to frame the news. Media will sometimes link to well-written blog posts for additional background, context or quotes.

Your investors’ PR team(s) may also help. Some investors will complement your news with their own blog post, help promote your funding via social media, aid in media outreach and conduct joint press interviews.

10. Build the Back Story

We’ll leave you with this sage advice from Wentworth – “A funding round is a news peg for a company, but milestones and numbers alone don’t make it a story. Weave in the human details that make it interesting. Is there something unique about how the deal came together? What’s the back story of a notable early customer or product breakthrough? The people part of business is what make stories memorable, and help differentiate a founder and her company’s brand.”

These are our winning tips to maximize your funding announcement. What are yours?

If you are an emerging growth company looking to learn more about managing your next investment round’s communications, fill out the form below and we will be in touch!